The average cost of health insurance in California per month is around $546 for an individual. For a family, the average is approximately $1,610 per month.

Health insurance rates in California can vary based on several factors, including age, location, income, and the level of coverage you choose. California offers a range of health insurance options through its marketplace, Covered California, as well as outside it.

Residents have the opportunity to select from various insurance carriers and plan types to find coverage that best fits their health needs and budgetary constraints. The state also provides subsidies for those who qualify, making health insurance more accessible for lower-income individuals and families. Understanding these options and the associated costs is crucial for Californians to ensure they select the most cost-effective and comprehensive health coverage available to them.

Introduction To Health Insurance In California

Welcome to the sunny realm of California, where the health insurance scene is as varied as its landscape. Grasping the cost of health insurance in this vibrant state is crucial. It ensures that individuals and families can access the care they need. Here, we introduce you to the ins and outs of health insurance in the Golden State.

Overview Of The Health Insurance Landscape In California

In California, health insurance comes in many forms. Residents choose from several providers and plan types, ranging from private companies to public programs like Medi-Cal. The state also runs Covered California, its own marketplace. This is where people apply for insurance policies that comply with the Affordable Care Act (ACA).

The Importance Of Health Insurance For Individuals And Families

Health insurance is a safety net. It protects against high medical costs and offers peace of mind. With insurance, Californians gain access to necessary medical services, from preventive care to life-saving treatments. For families, it’s a pillar of financial stability. It keeps medical emergencies from turning into financial crises.

Factors Influencing Health Insurance Costs In California

- Plan category: Platinum, Gold, Silver, or Bronze plans have varying premiums and out-of-pocket costs.

- Age: Premiums rise as individuals age, with those over 50 typically paying more.

- Location: Costs vary by region, as each county has different pricing dynamics.

- Income: Subsidies can lower costs for those with qualifying incomes.

- Household size: More family members covered often means higher overall premiums, but subsidies may help.

- Tobacco use: Smokers may face higher premiums due to associated health risks.

By understanding these factors, Californians can make informed decisions. They can choose the right plan that fits their budget and healthcare needs.

Credit: www.valchoice.com

Understanding Health Insurance Plans

Choosing the right health insurance plan in California is crucial. It can affect both your health and wallet. To make an informed decision, it’s important to know the different types of plans and their costs. Plans vary in coverage, provider networks, and out-of-pocket expenses. This guide breaks down the options, helping Californians find the best fit for their needs.

Differences Between Hmos, Ppos, Epos, And Pos Plans

Health insurance can be complex. Knowing the plan types helps in picking the right one. Here’s a quick look:

- HMO (Health Maintenance Organization):

- You need a primary care doctor.

- They give you referrals to see specialists.

- It usually covers care within its network.

- PPO (Preferred Provider Organization):

- More freedom to choose doctors and specialists.

- No need for a referral to see specialists.

- Covers both in-network and out-of-network providers, but at different costs.

- EPO (Exclusive Provider Organization):

- Select from the EPO network without referrals.

- Out-of-network care isn’t covered, except for emergencies.

- POS (Point of Service) plans:

- Blend of HMO and PPO features.

- You need a primary care doctor for referrals.

- Both in-network and out-of-network services are covered.

What Are Metal Tiers: Bronze, Silver, Gold, And Platinum Plans

California insurance plans come in four metal tiers. Each represents a level of coverage and cost sharing:

| Metal Tier | Coverage | Monthly Cost |

|---|---|---|

| Bronze | Lower premium, higher out-of-pocket costs. | Least expensive |

| Silver | Moderate premiums and costs. | Medium range |

| Gold | Higher premium, lower out-of-pocket costs. | More expensive |

| Platinum | Highest premium, lowest out-of-pocket costs. | Most expensive |

Out-of-pocket Expenses: Deductibles, Copayments, And Coinsurance

Out-of-pocket costs are what you pay when you get medical services. Understanding these terms is key:

- Deductibles

- The amount you pay for covered services before your insurance plan starts to pay.

- Copayments

- A fixed amount you pay for a covered health care service after you’ve paid your deductible.

- Coinsurance

- The percentage you pay for covered health care services after your deductible has been met.

Average Cost Of Health Insurance

Health insurance in California is vital for covering medical expenses. The cost of health insurance varies greatly. Factors such as age, plan type, and metal tier contribute to monthly premiums.

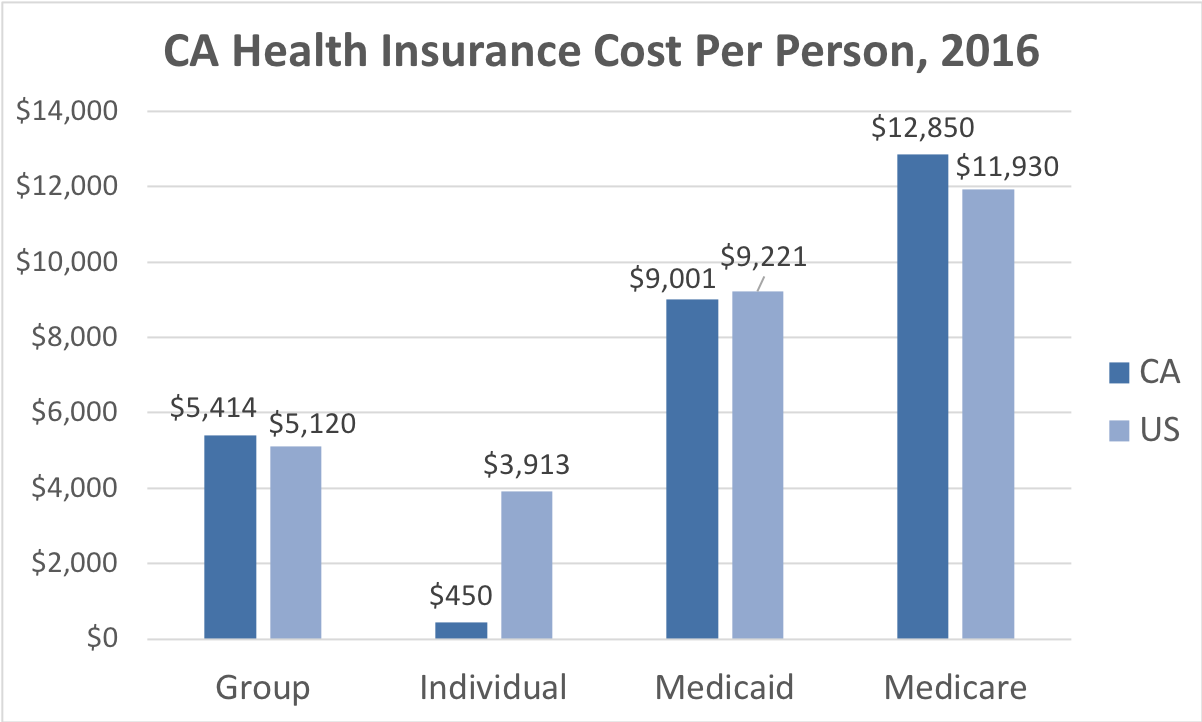

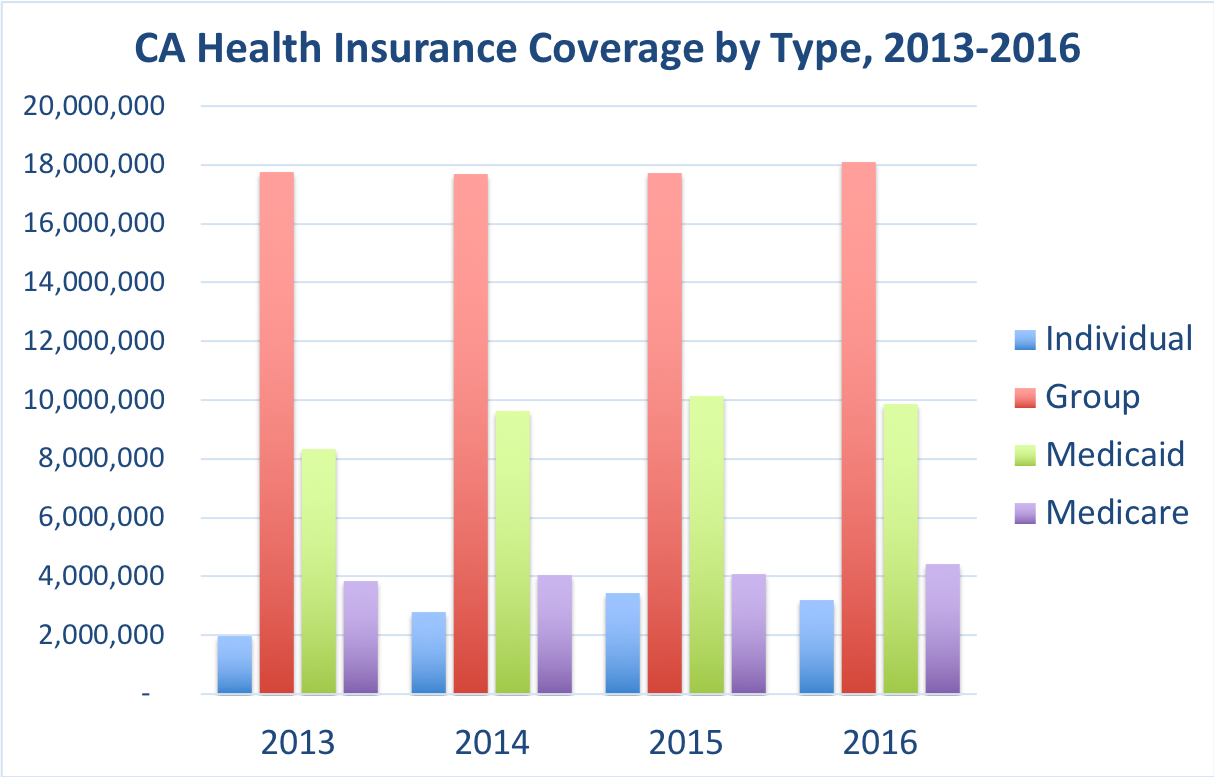

Statistics On Average Monthly Premiums In California

California residents pay diverse premiums for health insurance each month. A database of insurance rates provides insight into these costs. The average premiums shed light on the general pricing landscape of health insurance across the state.

- Individual plans may start from a few hundred dollars.

- Costlier family plans surpass this individual premium.

- Studying statistics helps gauge the expected expense range.

Comparing Costs Based On Plan Types And Metal Tiers

Different plan types affect premium costs in California. The metal tier system – Bronze, Silver, Gold, and Platinum – reflects coverage quality and price.

| Metal Tier | Average Monthly Cost |

|---|---|

| Bronze | Lower Premium |

| Silver | Medium Premium |

| Gold | High Premium |

| Platinum | Highest Premium |

Each tier comes with different out-of-pocket costs and deductibles.

How Age And Family Size Affect Monthly Premiums

Monthly premiums in California rise with the policyholder’s age. A younger individual’s premium is significantly less than that of an older individual.

- Young adults enjoy the lowest rates.

- Insurance costs increase as individuals age.

Family size plays a decisive role too. More family members included translate to higher premiums.

- An individual plan costs less than a family plan.

- Adding dependents increases the monthly fee.

Factors That Impact Insurance Premiums

Understanding health insurance premiums in California involves more than just numbers; it’s crucial to know the factors that impact these costs. From government policies to personal circumstances, various aspects determine how much you pay each month. Let’s explore these elements in detail.

The Role Of The Individual Mandate In California

The individual mandate is a state law. It requires all Californians to have health insurance. Those without it pay a penalty. This rule aims to ensure more people join the insurance pool, influencing the overall cost of premiums.

Income Levels And Eligibility For Subsidies

Your income plays a major role. It determines if you qualify for government subsidies. These are benefits that lower your monthly payments. People earn different amounts, so insurance costs can vary. Find out if you’re eligible for help to reduce your expenses.

Geographical Location And Its Effect On Pricing

Where you live in California makes a difference. Different areas have varying insurance costs. The reason includes the local cost of living, competition among insurers, and healthcare expenses. Check prices in your region to get the best rates.

Government Assistance Programs

Understanding health insurance costs in California can be complex. Government Assistance Programs exist to help ease this burden. These programs provide financial support, making healthcare more accessible and affordable for many Californians. Let’s explore California’s Medicaid program, the state’s insurance exchange, and subsidy eligibility.

California’s Medicaid Program (medi-cal) Eligibility And Benefits

Medi-Cal offers medical coverage to low-income individuals and families. Eligibility is based on factors such as income, family size, and disability. Benefits include doctor visits, hospital care, prescription drugs, and more.

- Doctor visits

- Hospital care

- Prescription medication

- Mental health services

- Dental care for children and adults

Understanding The Covered California Exchange

Covered California is the state’s health insurance marketplace. Here, Californians can browse and compare various insurance plans. Plans are standardized to make comparison straightforward. Users can see options for Bronze, Silver, Gold, and Platinum plans, each with different levels of coverage and costs.

- Browse and compare plans

- Standardized plan options

- Four levels of coverage

How To Qualify For Premium Assistance And Cost-sharing Reductions

Premium assistance helps lower the cost of monthly premiums for qualifying individuals and families. Cost-sharing reductions can reduce out-of-pocket expenses like deductibles and co-pays. Qualification depends on income and household size.

| Household Size | Income Range for Assistance |

|---|---|

| 1 | Up to $51,040 |

| 2 | Up to $68,960 |

| 3 | Up to $86,880 |

Applicants can apply for these programs through the Covered California website or in person at county human services agencies.

Credit: www.valchoice.com

Shopping For Health Insurance

Embarking on the journey to find the right health insurance in California can often feel like navigating a maze. With varied prices and numerous options, understanding the process is crucial. Let’s walk through the essentials to ensure a smart choice that fits both health needs and budget constraints.

Open Enrollment Vs. Special Enrollment Periods

Knowing when to shop for health insurance is the first step. Open enrollment is a yearly period to start or change coverage. Missed it? Special circumstances like life events trigger a Special Enrollment Period. This allows insurance shopping outside the usual timeframe.

- Open Enrollment: Typically runs from November 1 through January 15.

- Special Enrollment: A 60-day period following qualifying life events like marriage, birth, or loss of coverage.

Comparing Plans: Using Online Marketplaces And Brokers

With online marketplaces, Californians can compare plans side-by-side. Input personal information and see plans tailored to specific needs. Brokers are another resource, offering guidance and expertise to find the best-fit plan.

| Online Marketplaces | Brokers |

|---|---|

| Self-serve comparison of options | Personalized advice and support |

| Access to all major plans | May offer a wider range of options |

Key Considerations Before Choosing A Health Insurance Plan

Selecting health insurance demands careful thought. Consider these crucial factors to ensure a wise decision:

- Monthly Premiums: This is the monthly cost. Balance affordability with coverage quality.

- Deductibles and Copays: Check out-of-pocket costs before the plan pays out.

- Network of Providers: Confirm if preferred doctors and hospitals are covered.

- Prescription Coverage: Verify if necessary medications are included.

- Plan Type: HMO, PPO, EPO, or POS? Each has different rules for coverage.

Explore each plan’s details. Be mindful of benefits versus the total costs. Deciphering these aspects shapes the path to satisfactory health insurance cover.

Employer-sponsored Health Insurance

Figuring out health insurance costs in California can be complex. Still, if you have a job, employer-sponsored health insurance is a common perk. This coverage typically offers a balance between cost and benefits. Here’s a look into what it means for your monthly expenses.

Understanding Employer Contributions To Health Coverage

Employers often pay a portion of your health insurance. This means lower costs for you. The average employer contribution is a key factor in your total health care cost.

- Average contributions can vary widely by company.

- Some employers might cover more than half of the premium, while others offer less.

Comparing Employer-sponsored Insurance To Individual Plans

The value of an employer-sponsored plan shines when you compare it to individual plans. Group rates under employment often lead to savings.

| Plan Type | Average Cost for Single Coverage |

|---|---|

| Employer-Sponsored | $1,500/month |

| Individual Plan | $2,200/month |

These numbers are examples and can vary.

Cobra Coverage: Continuation Of Benefits After Employment Ends

When you leave a job, COBRA lets you keep your insurance for a limited time. However, you’ll pay the full premium plus an administrative fee.

- It’s the same coverage you had while employed.

- COBRA can last for up to 18 months after employment ends.

- A lifeline in case of unexpected job loss.

Credit: www.valuepenguin.com

Health Insurance For Special Populations

Understanding the cost of health insurance in California can be complex. Special populations have unique needs. Let’s delve into options available for students, seniors, and those with pre-existing conditions.

Covering Students And Young Adults Under California Laws

Young adults and students often juggle expenses. Affordable health coverage is crucial. California laws support them with several options:

- Parent’s Health Insurance: They can stay on until they turn 26.

- College Plans: Many colleges offer affordable plans for students.

- Covered California: Offers income-based discounts.

Insurance Options For Seniors And Medicare In California

Turning 65 brings new health insurance options. Seniors in California select from multiple Medicare plans. Each plan covers specific needs:

| Medicare Part | Coverage |

|---|---|

| A | Hospital Insurance |

| B | Medical Insurance |

| C (Advantage Plans) | Combined Part A and B with additional benefits |

| D | Prescription Drug Coverage |

Provisions For People With Disabilities And Pre-existing Conditions

California safeguards those with disabilities and pre-existing conditions. Health insurance must be fair. No one is denied based on their health history:

- Guaranteed Coverage: No denial due to medical history.

- Medi-Cal: It helps with low incomes and special needs.

- Pre-Existing Condition Insurance Plan: It’s a safety net for those denied coverage.

The Future Of Health Insurance Costs

Peering into the crystal ball, health insurance costs in California represent a significant concern for residents. Various factors will shape these costs. Let’s explore the predictions and potential changes that might occur in the Golden State’s health insurance landscape.

Insurance premiums often fluctuate. Different elements, including legislation, economy, and population health, influence these costs. Forecasting premium trends in California can help residents prepare for the future.

- Market Analysis indicates a trend of increasing premiums, albeit at a slower rate.

- Political actions could lead to stabilization of insurance markets.

- State-specific programs may offer new forms of coverage, impacting overall premium trends.

Health care reforms shape insurance affordability. California’s initiatives could make remarkable strides in managing costs. Here’s what is on the horizon:

- Legislators could pass laws focusing on price transparency and drug costs.

- Expansion of public options may provide competitive pressure on private insurers.

- Consumer protection reforms could limit out-of-pocket expenses, influencing monthly premiums.

Innovations within the healthcare system are key to reducing costs. California is at the forefront of these efforts, seeking to harness technology and efficient practices.

- Telehealth Expansion

- Telemedicine has surged, offering savings to both insurers and policyholders.

- Integrated Health Systems

- Blending services and providers can decrease administrative costs significantly.

- Preventive Care Focus

- Programs emphasizing early treatment and wellness to reduce long-term expenses.

Conclusion: Finding The Right Balance

Understanding health insurance in California can be tricky. As we wrap up, remember the key is finding a plan that fits both your health needs and your budget.

Weighing Cost Against Coverage: Finding Value In Health Plans

Finding the right health insurance plan means looking at more than just the monthly premium. Consider the following:

- Deductible: This is what you pay before insurance kicks in.

- Copayments and coinsurance: These are your out-of-pocket costs for services.

- Network: Make sure your preferred doctors and hospitals are covered.

Balance these factors to determine the plan’s true value.

Tips For Managing Health Care Expenses In California

Reducing your healthcare costs is possible. Follow these tips:

- Choose a plan that suits your regular medical needs.

- Use preventive services, often included for free.

- Stay within your plan’s network to avoid extra charges.

- Consider a Health Savings Account (HSA) for additional savings.

The Importance Of Staying Informed And Proactive About Health Insurance

Staying ahead of the game is crucial. Keep these points in mind:

- Review and understand your coverage annually.

- Stay alert to changes in California’s health insurance laws.

- Seek assistance if you’re unsure about your coverage choices.

Regularly checking your insurance options ensures you always have the best coverage.

Frequently Asked Questions On How Much Is Health Insurance In California Per Month

Is $200 A Month Expensive For Health Insurance?

The cost of health insurance can vary widely based on coverage, location, and personal factors. At $200 a month, it may be affordable for some, but others might find it expensive depending on their budget and healthcare needs.

How Much Is Health Insurance A Month For A Single Person In Us 2023?

The average monthly cost for individual health insurance in the US in 2023 ranges from $300 to $500. Prices vary based on location, plan type, and age.

Is $600 A Month A Lot For Health Insurance?

The cost-effectiveness of $600 a month for health insurance depends on personal factors such as age, location, income, and coverage needs. It may be high for some, particularly if it exceeds their budget or typical costs for their demographic.

How Much Does Covered California Cost Per Month?

The monthly cost of Covered California varies based on income, plan choice, and eligibility for subsidies. Plans can start as low as $1 after subsidies.

Conclusion

Navigating the nuances of health insurance premiums in California can be complex. The monthly cost varies widely based on personal circumstances and the level of coverage desired. As residents evaluate their options, it’s crucial to consider both the financial and health implications of their choices.

Seeking tailored advice may ensure the best outcome for individual needs and budgets in the Golden State.